Undoubtedly, the majority of us have started our financial life earlier than in 20 years old. However, this age is the main starting point for more advanced banking operations. For instance, at this age, many people open their savings accounts, start investing, get credit cards, and make big purchases. However, a little part of all these people does think of constructing their credit score in order for it to be good in the further financial life.

However, one can ask: What is a good credit score at all? Stay with us to read the article below and know what a good credit score is, what benefits it may bring to you, and how to create a worthy credit score.

Acquaintance with Credit Score

A credit score is a three-digit number stored in banking systems and corresponds with your bank account. It helps lenders to see whether you are a trusty person to give money to and how likely you are to repay the loan.

Although there are many various types of credit scores, the most frequently used in the US is the FICO® credit score. It takes the range of 300-850, where the lower score corresponds to the worse borrower status and vice-versa.

What is a Good Credit Score for My Age?

After getting to know what a credit score is, there may appear a question on what a good credit score is. The answer is 700 and above. However, let’s dip further into this topic.

FICO® has several categories for distinguishing the character of each particular credit score range. For instance, in accordance with several criteria, the score of 630 is called “fair”, whereas 670-739 corresponds to a “good” one. Going further, 740-799 is “very good,” and finally, 800-850 is “exceptional”.

Nevertheless, it is almost impossible to get a good credit score in your early 20s since you are only starting your credit history. Thus, the average credit score for 18-24 years old is just 630. Surprisingly, the average score for 25-30 year-olds is 628!

According to all these new facts, we can say that the perfect credit score for your 20s is no lower than 650, and the closer to 700, the better.

However, do not be afraid to start. The statistics are constructed taking into account the length of one’s credit history. Therefore, even if your credit score is 500 right after the day you took your first loan, it doesn’t really matter. Most importantly, make sure to make regular repayments and close your debt in time. Thus, form your financial habits in advance starting from an early age.

Average Credit Score by Years

Now you know how the credit score ranges vary. From this point, you can think of the factors that affect the distribution of the categories on the lifespan periods.

Remember that in your 20s, you are only at the beginning of the financial path. Each time you take a new credit card, borrow a loan from special organizations or forget about repayment, your credit score suffers and decreases rapidly. However, the fact that your credit history is not that long may help you if you are going to join the right track in the next decade.

When you are in your 30s, you are considered to have enough time to establish your credit history. It means that the bank expects you to have some loans already but to repay them regularly at the same time. Now it is time for a new theory to know: if you take a car loan or mortgage, your credit score increases. Therefore, in your 30s, you are expected to have some closed debts along with several big loans.

In the next decade, the length of your credit history expands along with your credits probably. Thus, the credit score is very mixed, and it is getting harder to understand how it is generated. Since the 40s and 50s are considered to be prime years, your income should be nourishing enough for you to be able to take a new loan and repay older debts at the same time. Additionally, the higher is your income, the bigger is the possible border for the credit limit, which increases your credit score too.

The 60s is the age of preparing for retirement. Most likely, you are already heading to reduce and fully repay your debts along with settling your lifestyle to a fixed income. So, the chances to take a new credit are considered to be low at this age. Nevertheless, the law is definitely on your side! The Equal Credit Opportunity Act (ECOA) prohibits lenders from underestimating and discouraging you from taking a new loan. Moreover, ECOA claims the credit score models to give favors to people of this age group.

So, let us conclude the age ranges and the perfect average credit scores for them (by FICO® scale):

Average credit score for 18-year-old – 631

Average credit score for 19-year-old – 644

Average credit score for 20-year-old – 681

Average 21-year-old credit score – 670

Average 22-year-old credit score – 664

Average credit score for 23-24-year-old – 661

Average credit score for 25-year-old – 659

Average credit score for 26-39 year old – 659-673

Average credit score for 40-49-year-old – 684

Average credit score for 50-59-year-old – 706

Average credit score for 60+year-old 749

What Affects My Credit Score

It is highly significant to understand that the FICO® credit score model does not take into account the exact age of the person, but it considers the length of one’s credit history. That is why you should think of launching your credit history wisely. Imagine, if you take your first loan at 19-years-old, your overall credit history length will, on average, be bigger. Thus, you will have to pay more attention to the repayments (deposit more often or in bigger sums) in order to give a more powerful boost to the credit score.

Another influential factor is the number of credits. By comparing two individuals with the same relatively short credit history, one of which has many credits, and another having few of them, the latter will have a higher credit score, indeed.

So, it is time to see more accurate descriptions of these influential factors and their power:

35% of your score is rooted in your payment history (how regularly you do repayments and their amount)

30% is based on your amounts owed (official income, self-employment, alimony, or other social benefits)

15% is based on the length of your credit history

10% is based on the types of credit you’re using (for instance, student loans, mortgage, or credit cards)

10% is based on inquiries for new credit (how many of them and for which purposes)

What Can I Benefit From Having a Good Credit Score?

Undoubtedly, you partially know the answer to this question. Many things depend on the quality of your credit score. Not to mention taking new credits, buying a car or even a house, or finding money for an instant medical operation.

Having an insufficient credit score may cost you having a new credit card, buying any necessary staff for life. Moreover, the credit score you have may influence the interest rate you get when taking a new credit or making a deposit. It is because the credit score displays your financial practices and habits. Meaning that people with bad scores are less likely to pay for the existing loans, so why should the creditors trust them?

Therefore, a good credit rate can not only give you an opportunity to take new credits but also save money on having a lower interest rate for them.

How to Improve a Credit Score?

You can use the following instructions both when you are just maintaining your score and want to proceed with good characteristics in further life, and if you are having bad times now and want to increase this 3-digit number:

Make all your payments on loans on time. Since it is the biggest part of the credit score formula, try to pay attention to this factor in the first place.

Do not forget about the amount of your credit utilization, which is how much from the borrowed money you use. Do not be too harsh, and do not try to exhaust all your cards during one month.

And remember not to open too many credit accounts. Taking too many loans in a short period of time may look precarious from the point of view of creditors.

Your Credit Score’s Future is in Your Hands

So, as you can see, your credit score is one of the most important measurements in your life. It influences all your life opportunities in the future. Therefore, you should think of making it perfect right at the beginning of your financial path.

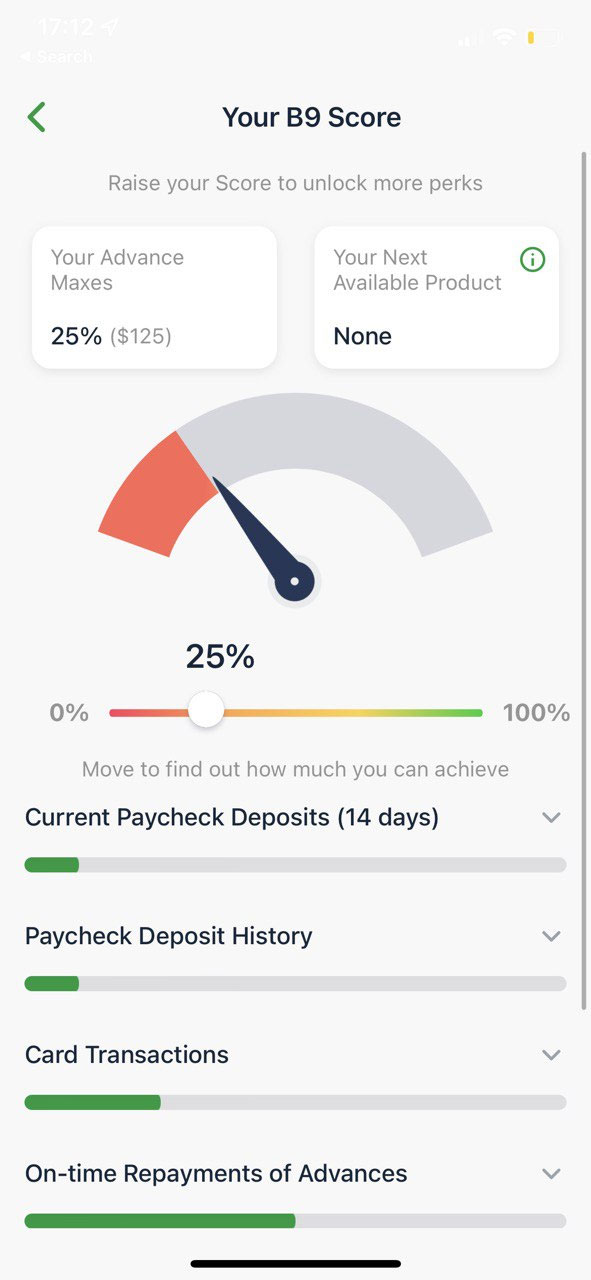

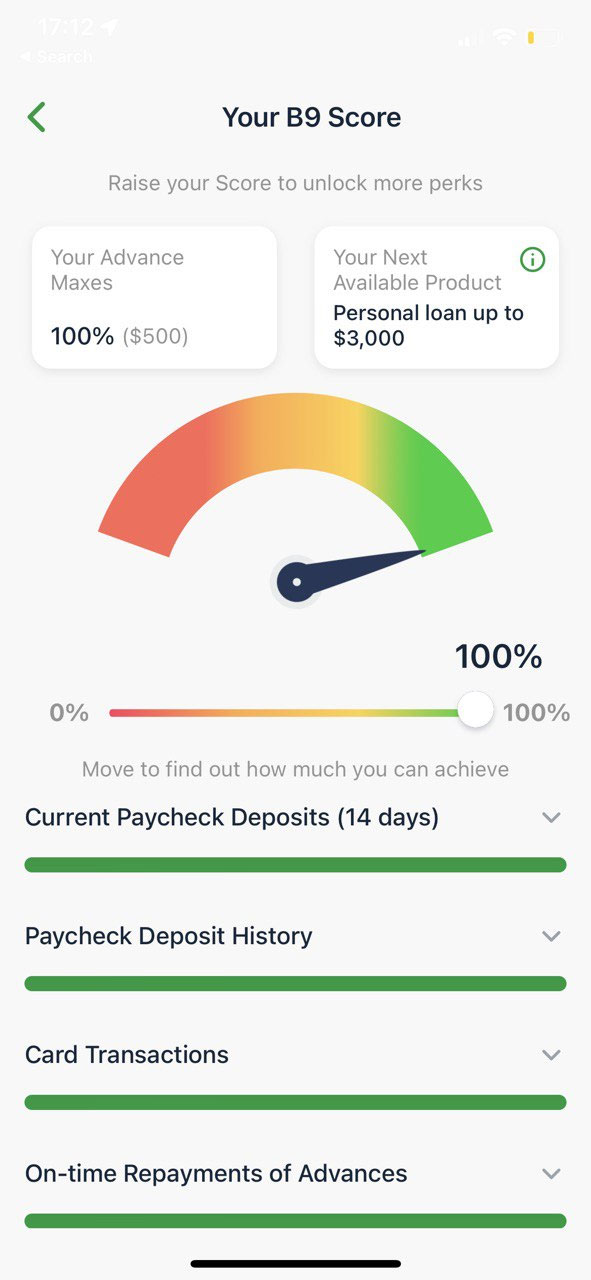

B9 Score

B9 also have his own internal score. With B9 you can forget about loans forever, once you reach out 100% your next product will be available, it could be a personal loan or a credit card, depending on what you need most.