Need Help?

Hablamos Español

Hablamos Español

B9 speaks Spanish

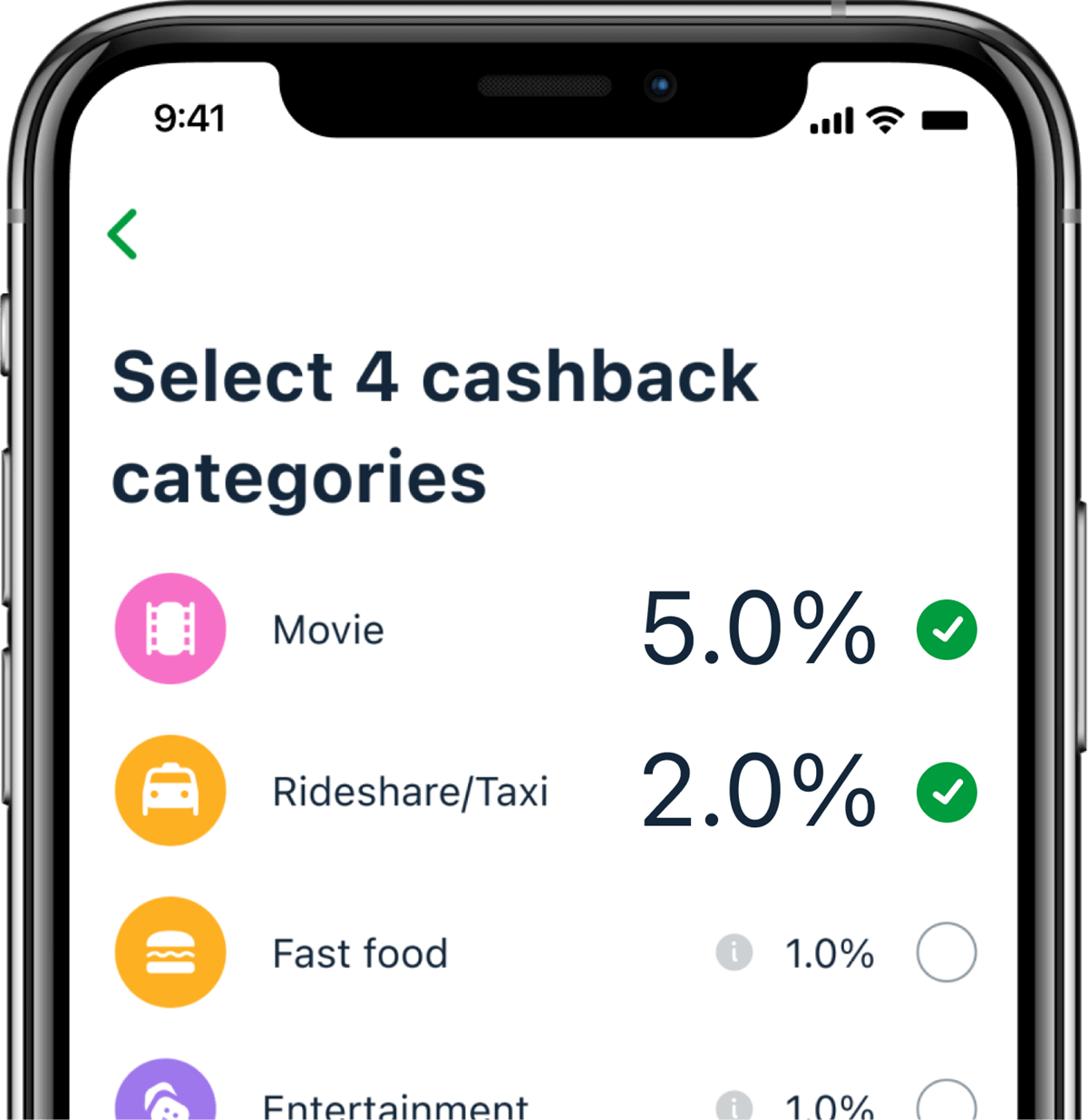

Select your top spending categories each month, and your cashback will be deposited into your rewards account right after the eligible transaction settles.

You will begin to earn cash back each month once you spend $200 within the categories selected.

* B9 is not a bank. B9 Card is issued by Evolve Bank & Trust pursuant to a license from Visa. Rewards are not offered by Evolve Bank & Trust and are instead offered and managed by B9. The Cashback Rewards Program is governed by the terms and conditions set forth in the Cashback Rewards Disclosure (“Disclosure”). You will receive the Disclosure with your Cardholder Agreement. The Disclosure will explain the Cashback Rewards Program, including the following: 1) You may earn up to 5% cashback rewards on eligible net purchases. The cashback rewards amount will be determined by aggregate spending activity at eligible merchants. Consult your Disclosure for cashback limits. A net purchase is the amount of a purchase less any credits, returns and adjustments. Certain transactions do not qualify for cashback rewards including: balance transfers, cash advances, account fees or charges, interest charges, life insurance charges, money orders, wire transfers, lottery tickets, gambling charges, or unauthorized charges to your account. Please refer to your Disclosure for complete program terms and conditions. 2) Cashback Rewards will not expire as long as your B9 account is in good standing. 3) Undistributed cashback rewards are forfeited if the cardholder closes their account prior to the cashback reward disbursement. 4) Program subject to change. 5) You are solely responsible for any taxes that may be owed as a result of cashback rewards earned and/or redeemed under this card. Please consult your tax advisor. 6) Other terms may apply and will be included in the Disclosure.

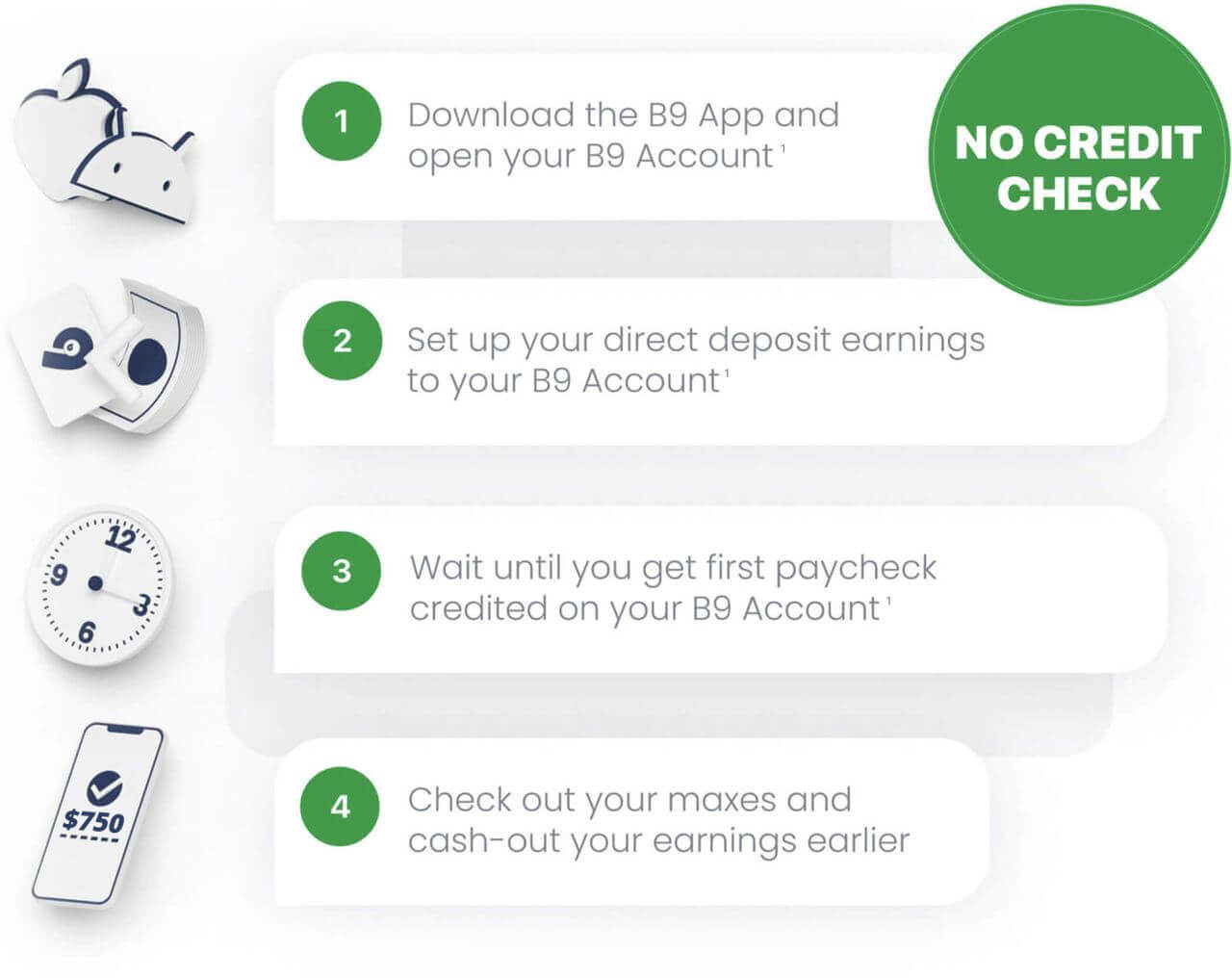

* B9 Advance℠ are optional service, offered by B9 to its members that require to set up and maintain a direct deposit to B9 Account. All B9 members are informed of their current available maxes in the B9 mobile app. For B9 Advance Terms and Conditions and eligibility requirements apply. Not all users will qualify. Advances amounts range from $30 to $750. New users are usually offered Advances of between $30 to $50. Average approved advance for B9 Basic plan is $81 and the average approved advance for the B9 Premium plan is $257 as of December 2024. See Terms of Services or contact B9 via support@bnine.com for additional terms, conditions, and eligibility requirements. May not be available in all states.

Their limit may change at any time, at B9’s discretion. B9 subscription is $0 for all clients whose direct deposit amount transferred to their B9 Account is more than $5,000/month. Deposits from multiple employers count. Government benefits also qualify. This does not exempt other fees, see the Terms of Service or contact B9 via support@bnine.com.