Here’s an idea—how about on top of the money you already earn, we get you a little more?

Just decide which cashback categories make the most sense based on your spending patterns, then spend at least $200 a month within those categories.

Boom — your cashback gets put into your bank account by the 5th day of every month.

Evolve Bank & Trust, a technology focused financial services organization and Banking-as-a-Service (“BaaS”) provider, is a best in class financial institution offering specialized services in Open Banking, Personal and Business Banking, Mortgage, SBA Lending, Physicians Capital, and Trust. For more information about Evolve, go to: www.getevolved.com.

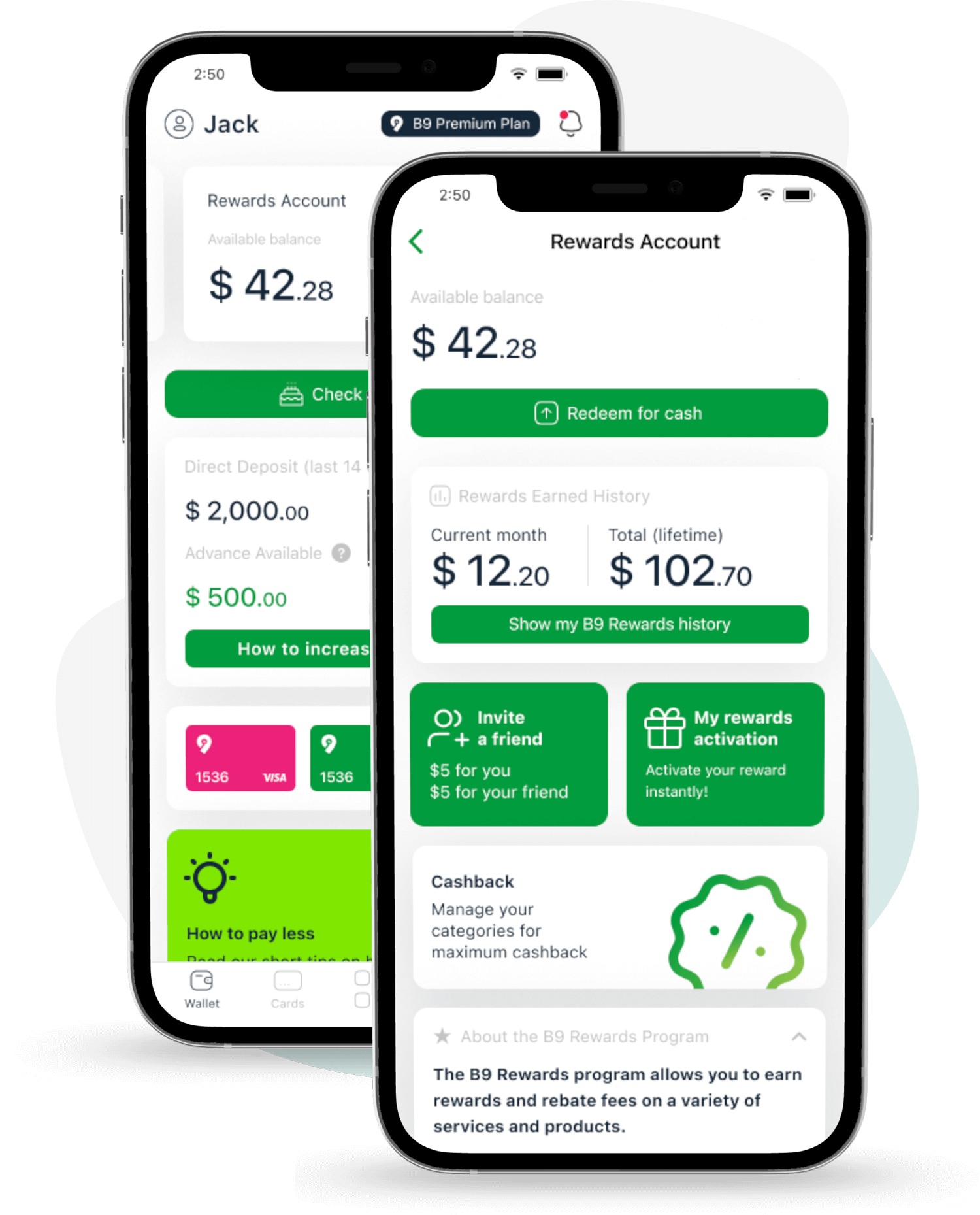

Earn cashback daily! Select your top spending categories each month, and your cashback will be deposited into your rewards account right after the eligible transaction settles.

You'll begin to earn cashback as soon as you've spent a total of $200 from your combined categories.

Choose your categories for cashback. You'll then see the ones you chose for that particular month. Keep in mind, you'll need to choose new categories (or keep your old ones) every month.

Earn by inviting friends, completing enjoyable tasks, and sharing your opinions in surveys. Easily keep track of your rewards history all in one place

Cashback Amount

0.5% to 5.0%

Criteria

Depends on the merchant category codes selected

How and When Will I Receive My Cashback Rewards

Your cashback rewards will be automatically deposited into your B9 Account and can be used for any purchase or can be electronically transferred to a different account.

Monthly cashback amount will be credited to your account on the 5th of the following month.

NO minimum balance,

NO overdraft fees.

Your deposits are fully insured up to $250,000 through Evolve Bank & Trust, Member FDIC. Plus, we use the Payment Card Industry Data Security Standard (PCI-DSS) to protect and encrypt all your information. So, join with full confidence the hundreds of thousands of others who’ve already signed up.