Senior Product Manager

Position Overview

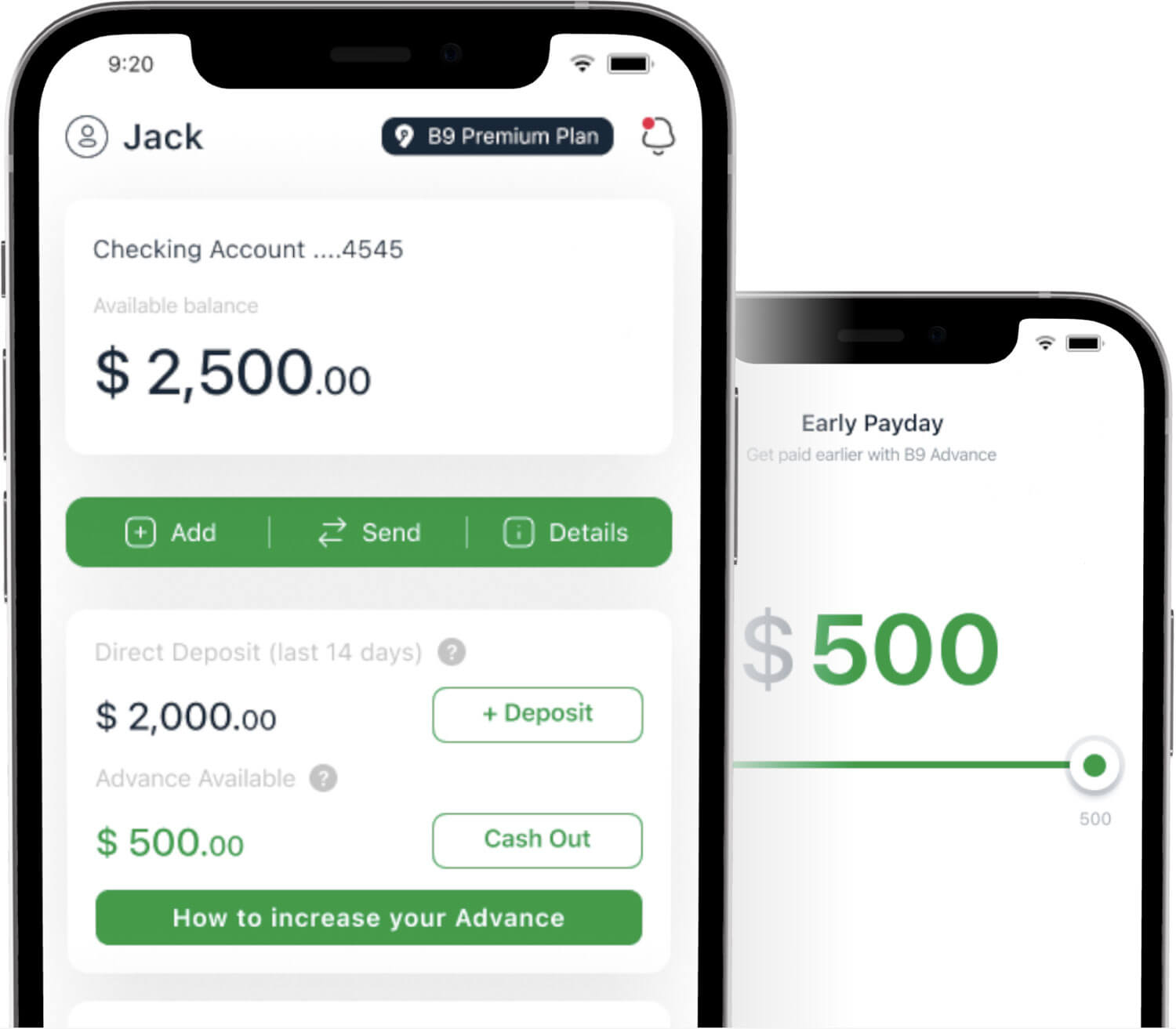

As Senior Product Manager, you will be responsible for scaling our Line of Credit offering and building the next set of product innovations and features to drive the growth of our core business. You will work cross-functionally with engineering, design, compliance, data analytics, marketing, and operations teams to optimize approval rates, repayment flows, retention, and unit economics.

You’ll lead the expansion of our early paycheck access product, identify growth opportunities, and ensure a compliant, customer-first experience. This role requires a data-driven mindset, deep customer empathy, and the ability to thrive in a highly regulated, fast-paced environment.

Key Responsibilities

Product Strategy & Roadmap

- Define and own the vision, strategy, and roadmap for B9’s credit product.

- Identify opportunities to improve retention rates and unit economics.

- Partner closely with compliance teams to ensure all features meet Reg E, Reg Z, TILA, and ACH authorization requirements.

- Conduct competitive research and customer insights analysis to inform new product features and strategies.

Execution & Delivery

- Lead cross-functional squads (engineering, data, marketing, and design) to deliver high-impact initiatives.

- Write and review PRDs, wireframes, and experiments.

- Drive A/B testing and implement learnings to improve conversion, approval, and repayment rates.

- Collaborate with growth teams to enhance user acquisition, onboarding, and product utilization.

Data & Risk Optimization

- Lead fine-tuning of underwriting policies leveraging alternative data sources and machine learning models.

- Monitor key KPIs including approval rates, repayment success rates, utilization, portfolio-level credit losses, and customer retention.

- Ensure fraud detection and loss mitigation strategies are integrated into the product roadmap.

Qualifications

Required:

- 5+ years of B2C product management experience in fintech, banking, or lending.

- Proven track record in launching and scaling credit products, especially in credit lines, EWA or credit-builder models.

- Strong understanding of ACH authorization flows, digital wallet integrations, and repayment mechanisms.

- Deep familiarity with U.S. regulatory frameworks, including Reg E, Reg Z, TILA, and relevant state lending laws.

- Data-driven decision maker; experienced with analytics platforms (Amplitude, Looker, SQL).

- Experience collaborating with risk, compliance, and credit analytics teams.

- Exceptional communication and stakeholder management skills.

What We Offer

- Competitive salary

- Health benefits

- Remote-friendly within the U.S. and flexible time off (FTO)

- Clear opportunities for growth and career development

- A high-growth, mission-driven culture where your work has visible impact