Build Credit History From Scratch

Designed for those with little or no credit history

Prove Your Reliability

Take out a small loan and show lenders you’re a responsible borrower

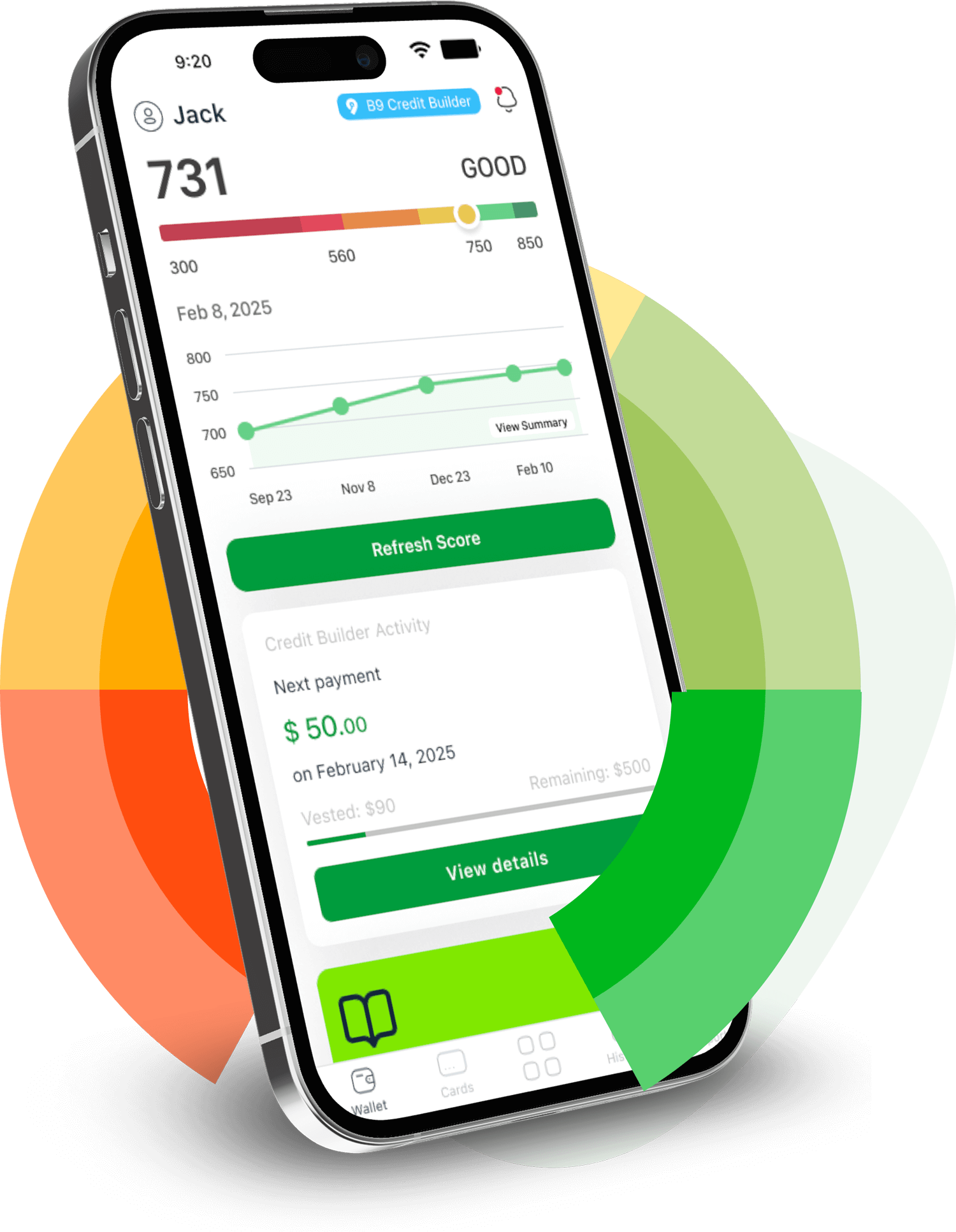

Track Your Credit Score

Regular on-time payments help establish positive credit behavior

Your credit score reflects your financial history and helps lenders assess your ability to repay debts. If you have little or no credit history, you may be seen as a risky borrower. B9 Credit Builder loans help change that by securing funds in an account as collateral while giving you a chance to build a solid financial profile.

So how does it work? Just like traditional loans, your payment activity is reported to all three major credit bureaus—Equifax®, TransUnion®, and Experian®. Since payment history is the biggest factor in most credit scores, making on-time payments can significantly build your credit.

With a B9 Credit Builder loan, you take out a small, manageable amount of debt and prove your reliability by paying it off on schedule. However, missing payments can harm your score—late payments stay on your credit report for up to seven years. That’s why consistency is key.

Use a B9 Credit Builder loan wisely, and it can be a powerful tool to strengthen your credit history, unlocking better financial opportunities in the future.

Build your credit history while setting aside savings with B9 Credit Builder. Access your account now to start growing your credit the smart way!

B9 Credit Builder loans are issued by Cross River Bank, Member FDIC (“CRB”) and serviced by BuildCredit LLC. Loan proceeds are deposited into a savings account provided by CRB and are insured up to $250,000. FDIC insurance covers accounts held with CRB in the event that CRB fails.